美國(guó)北方天空研究公司(Northern Sky Research,以下稱NSR)的《平板衛(wèi)星天線報(bào)告(第二版)》近日發(fā)表,并預(yù)測(cè)到2026年,平板天線設(shè)備的累計(jì)銷售額將達(dá)到91億美元。

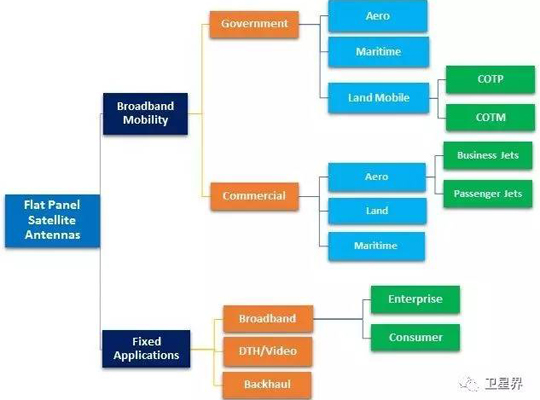

作為在這一新興技術(shù)領(lǐng)域中唯一的多用戶報(bào)告(multi-client report),其文中指出對(duì)于制造商來(lái)說(shuō),航空設(shè)備將驅(qū)動(dòng)收入的增長(zhǎng),同時(shí)非同步軌道衛(wèi)星的固定寬帶業(yè)務(wù)將占據(jù)主體市場(chǎng)份額。

平板天線,或者確切來(lái)說(shuō),相控陣天線從上世紀(jì)80年代起就開(kāi)始部署使用,但主要受成本和性能因素影響一直不溫不火。NSR分析師,該報(bào)告的合著者之一Prateep Basu表示:“沒(méi)有哪一種特定的平板天線技術(shù)能滿足所有需求,因?yàn)槊總€(gè)市場(chǎng)不光有各自特定的性能需求,還有不少管理負(fù)擔(dān)與經(jīng)濟(jì)限制。”

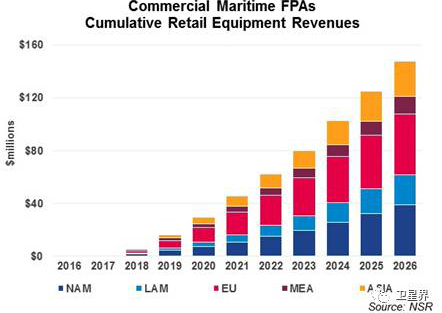

雖然在移動(dòng)市場(chǎng)中愈發(fā)收到歡迎,針對(duì)移動(dòng)應(yīng)用的平板天線預(yù)計(jì)將仍維持高價(jià),這主要?dú)w因于其技術(shù)的復(fù)雜性。NSR同時(shí)預(yù)測(cè)到2026年,得益于機(jī)上連接、海上休閑以及已有的政府部門(mén)陸地移動(dòng)業(yè)務(wù)需求的快速增長(zhǎng),移動(dòng)業(yè)務(wù)部分的收入在平板天線設(shè)備總收入中的占比,將超過(guò)92%。

衛(wèi)星寬帶應(yīng)用受OneWeb和SpaceX等公司的低軌高通量衛(wèi)星星座運(yùn)營(yíng)情況帶動(dòng),是固定衛(wèi)星業(yè)務(wù)發(fā)展預(yù)測(cè)的主要影響因素。至預(yù)測(cè)時(shí)間段截止前,200萬(wàn)顆更低價(jià)格的平板天線將被部署以向中東和亞洲等地區(qū)提供服務(wù)。

“當(dāng)今市場(chǎng)很明顯被商業(yè)航空連接業(yè)務(wù)主導(dǎo)。但是,新的平板天線制造商在衛(wèi)星產(chǎn)業(yè)價(jià)值鏈中所采用的合作模式,將有助于提升特定市場(chǎng)的垂直發(fā)展速度。這也將塑造一種面向明確需求的商業(yè)模式。”NSR分析師及報(bào)告的另一位合著者Dallas Kasaboski補(bǔ)充道。

原文閱讀:

IT’S A MOBILE WORLD FOR FLAT PANEL ANTENNAS

NSR’s Flat Panel Satellite Antennas, 2nd Edition(FPA2)report, released today, forecasts cumulative FPA equipment sales to reach $9.1 billion by 2026.

As the only multi-client report on this emerging technology, NSR’s FPA2 finds that aeronautical equipment will drive revenue growth for manufacturers, while fixed broadband services from non-GEO satellites will be the main volume market.

Flat Panel Antennas (FPAs), and more specifically, phased array antennas, have been deployed since the 1980s. Their cost and performance have been the major factors holding back the potentially ‘game-changing’ technologies.? “There is no one specific FPA technology that fits every need, as each market has its own specific performance requirements that come with the weight of regulatory and economic constraints,” stated Prateep Basu, NSR Analyst and report co-author.

Technical complexity of FPAs for mobile applications is expected to keep antenna prices high, even as they become more viable in mobile markets. Combined with the rapidly rising number of airlines pursuing in-flight connectivity, large leisure maritime markets, and the established land-mobile government sector, NSR expects mobile applications to drive FPA revenues, accounting for over 92% of total FPA equipment revenues, by 2026.

Satellite broadband applications, driven by the expected operationalization of LEO-HTS constellations like OneWeb and SpaceX, are the main drivers of the Fixed Applications forecast, delivering services over 2,000,000 lower-priced FPAs by the end of the forecast, primarily to the Middle East and Asia.

“The market today is clearly dominated by commercial aviation connectivity markets.? However, partnership models that new FPA manufacturers are adopting across the satellite industry value-chain can be expected to accelerate vertical market-specific development.? This will also shape business models that cater to a definite demand for such equipment,” added?Dallas Kasaboski, NSR Analyst and report co-author.

粵公網(wǎng)安備 44030902003195號(hào)

粵公網(wǎng)安備 44030902003195號(hào)